The phaseout of SAP ECC is reshaping hiring trends across industries. With SAP CCS support ending in 2027, more than 60% of businesses still rely on legacy frameworks. Yet, SAP hiring declined in 2024, suggesting that many firms have yet to fully commit to migration. Will this trend reverse as the deadline nears?

SAP consulting firms, by contrast, are experiencing record recruitment. If current activity persists, vacancy levels will surpass previous highs. Migration to SAP S/4HANA remains a priority, with firms such as NTT, DXX, and Cognizant actively expanding their teams to meet rising demand.

At the same time, the broader transition from SAP ECC to cloud-based ERP solutions is reducing reliance on in-house specialists. Could this signal a long-term shift away from traditional SAP roles outside of consulting?

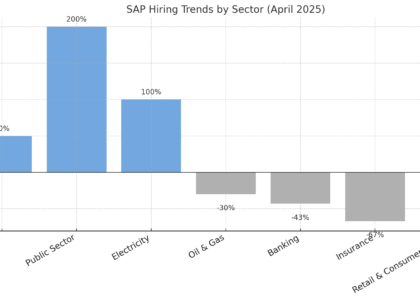

With this, SAP hiring is accelerating in key areas:

- IT Services: Nearly half of all SAP vacancies in Europe in 2025 are in IT services.

- Consulting: The sector’s market share grew by 6%, while accountancy and medical device hiring remained stable.

- Management: SAP Manager vacancies surged by 50% in 2024, with France (62%) and Germany (75%) leading growth. Hiring in the UK remains strong in early 2025.

- Architects: Demand for SAP Architects rose by 55% as firms sought expertise for migration strategies. With many accelerating transition plans, will this trend persist as 2027 approaches?

Also, the retail & consumer goods and services sectors saw a 39% drop in IT vacancies in 2024. Yet, demand for SAP professionals remained steady. If current hiring patterns hold, SAP vacancies in these industries could rise by 53.8% in 2025.

Companies are expanding their teams as they move away from SAP ECC, but what other factors are fueling this hiring surge?

The Geography of SAP Hiring

London remains the UK’s dominant SAP hiring hub, accounting for half of all vacancies. However, regional trends indicate a more nuanced picture:

- North & South: Hiring picked up in late 2024. The North saw a peak in January 2025, reaching its highest vacancy levels since May 2021.

- Midlands: While overall demand is lower, vacancies have remained stable.

Does this signal a broader geographic rebalancing of SAP roles within the UK?

A European Market in Transition

SAP hiring in Europe contracted in 2023 before rebounding in 2024.

- Germany recorded over 2,000 SAP vacancies in 2022, but this fell nearly 25% by 2024.

- The UK followed a similar trend, with vacancies dropping 36%.

- Spain bucked the trend, with SAP vacancies rising 36%.

- Across Europe, vacancies reached nearly 4,000 in 2024.

The UK saw a sharp contraction in SAP developer roles in 2024, but early 2025 data suggests a strong rebound. Germany, which led in SAP S/4HANA adoption, is now seeing hiring slow following last year’s surge.

Is the UK’s hiring uptick a sign that more firms are now transitioning and customising their SAP environments before ECC support ends in 2027? And will hiring accelerate further as the deadline nears?